The Real Aussie Financial Bite Report 2023

14 Feb 2023

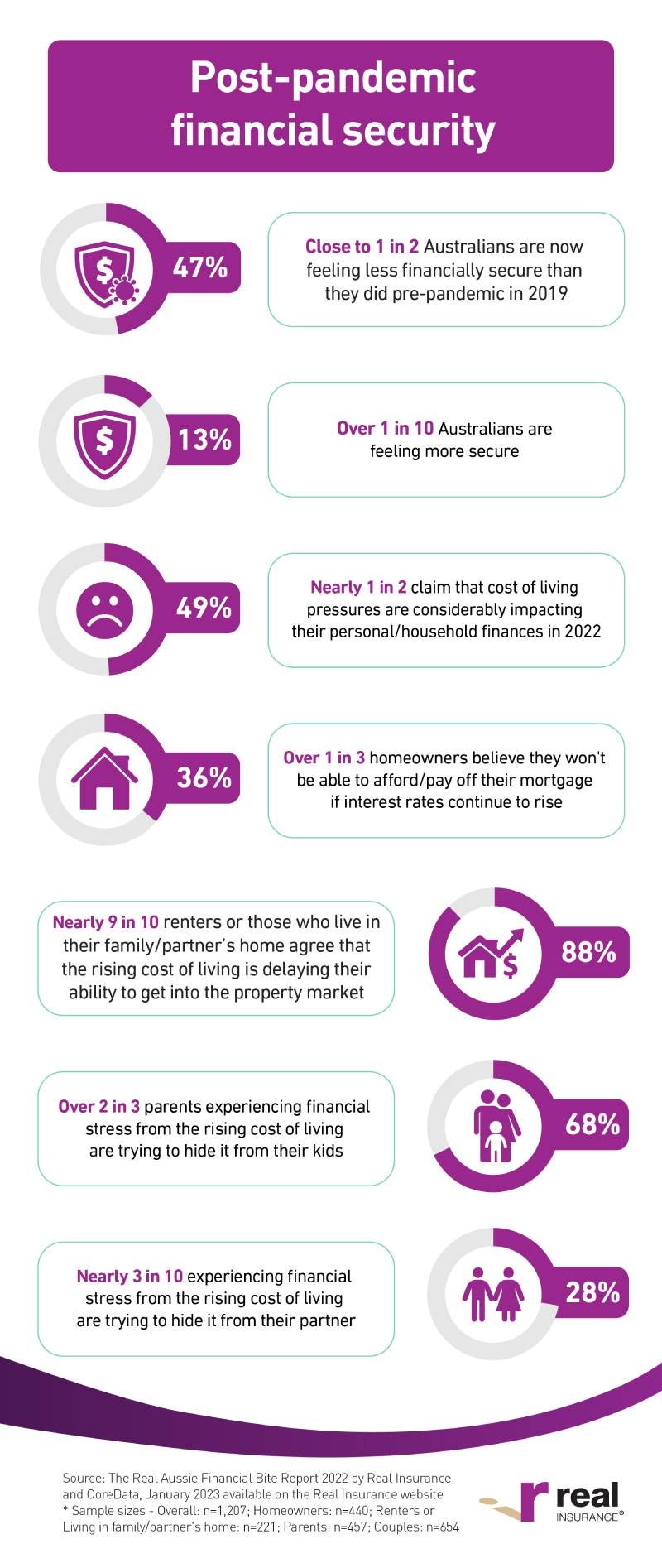

After two years of disruption and uncertainty, Aussies enjoyed a year largely unaffected by lockdowns. International borders reopened, venues stayed open, and we embraced a ‘new normal’. As the country finally begins to recover from various crises – COVID-19, bushfires, droughts, and floods – Aussies are finding themselves in a very different financial environment compared to a year ago, and a far cry from the pre-pandemic economy.

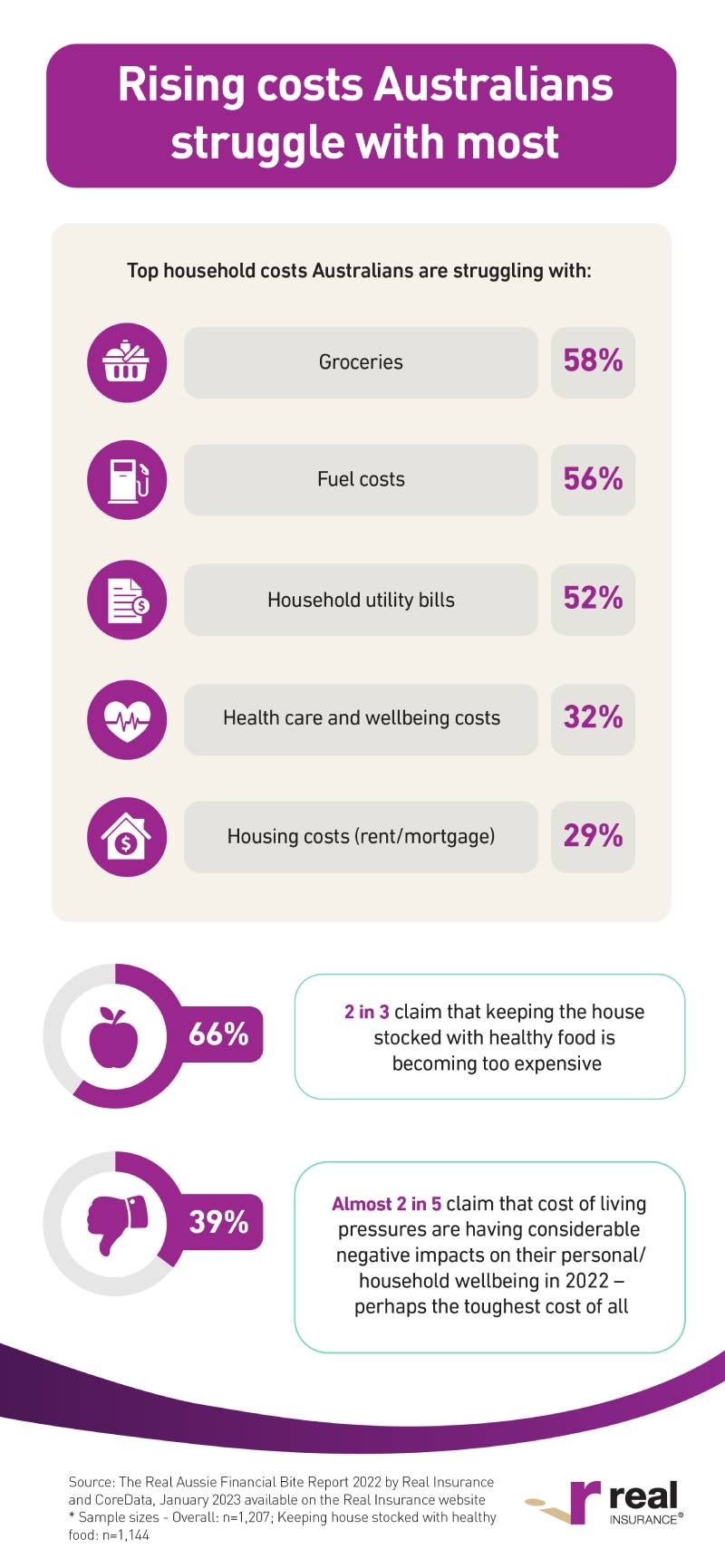

As the price of groceries, fuel, electricity, and other living expenses continue to rise across the country, Aussies are feeling the bite and having to fork out more on the essentials. And while many have been reconciling these increasing costs and making changes to their plans and spending habits, surging prices have negatively impacted nearly 1 in 2 personal or household finances.

But how are we adapting to the soaring costs? What are we willing to sacrifice, and what are we not willing to compromise on?

The Real Aussie Financial Bite Report is the latest edition in the Real Insurance research series and explores the current cost of living in Australia – diving deep into the sentiment, concerns, preferences, and non-negotiables, as well as the impacts of financial pressure on our health and wellbeing.

Coping with the rising cost of living

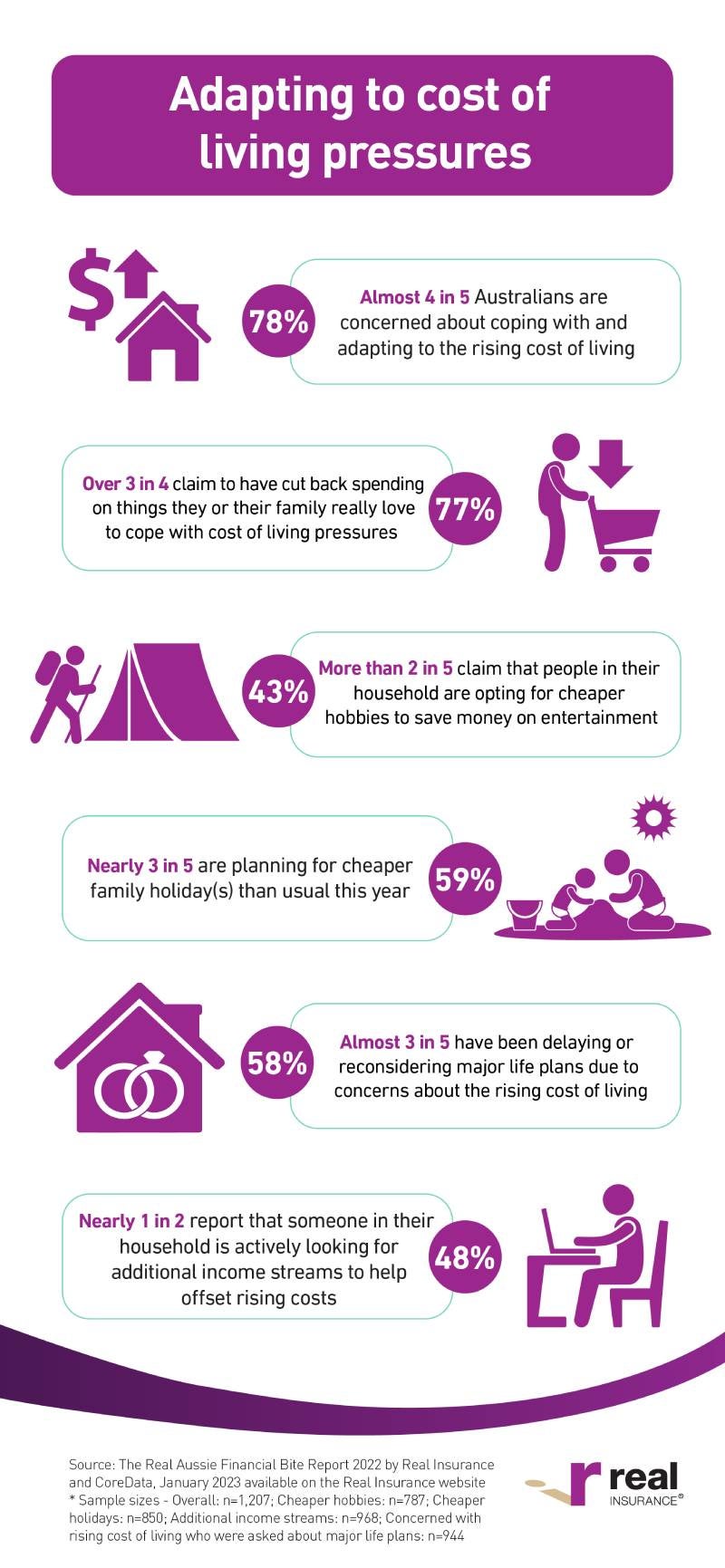

Nearly 2 in 5 (36%) Aussies are very concerned about coping with the rising cost of living. The rising costs of household necessities including groceries (58%), fuel (56%), and household utility bills (52%) are the household costs we are struggling most with. We are adapting to the tightened financial situation by overhauling our spending and reevaluating where we want to spend our hard-earned money.

In fact, almost half (49%) surveyed are happy to give up socialising, entertainment, and eating out, closely followed by take-away and home delivery (46%). And over 2 in 5 (43%) are even willing to forgo their take-away coffee!

Overall, more than 3 in 4 (77%) have estimated that they have reduced spending on things they or their family really love to cope with soaring costs.

The financial bite means Aussies could be looking to have a very different festive season this year. Tightening our spending has seen over half of us (51%) take to bargain hunting for weekly specials and sales, cutting back on eating out (47%), joining loyalty programs (40%), stretching home cooked meals for longer periods of time (37%), and buying more home brand products (33%).

However, despite our financial concerns, we are still prioritising the upkeep of our healthy lifestyles – not willing to part with providing our households with quality healthy food (44%), or the costs involved with maintaining a healthy lifestyle (30%) in view of the rising cost of living pressures.

Budget holiday plans are on the horizon

As we rejoiced to the news of international travel earlier this year, our holiday plans are now also impacted by the increasing costs of living.

Almost 1 in 3 (31%) Aussies are cutting down on holiday spend, with annual holidays coming in fourth in the list of things we are most likely to sacrifice on in view of the rising cost of living pressures (41%). Conversely, less than 2 in 10 (17%) are not willing to sacrifice our annual holiday to alleviate some financial pressure.

With local and global travel options back on the table, nearly 3 in 5 (59%) households are planning for cheaper holiday options than usual, and nearly a quarter (23%) are putting off extensive travel due to cost of living concerns.

It’s not only holidays that are getting cut this year. Major life changes are being delayed or cancelled also (58%), including big ticket purchases (28%), and taking time off for extensive travel (23%).

Cost of living dilemma in property bubble

Homeowners and prospective homeowners alike have been watching the RBA interest rates this year as they continue to climb.

As the next potential rate hike looms, a third of homeowners (36%) agree that they will be unable to pay off their mortgage if rates continue rising.

For those who are currently renting or living in their family/partner’s home and want to join the property market, nearly 9 in 10 (88%) said the rising cost of living is delaying their ability to make the jump.

Financial stress impacting relationships

As we enter 2023, the general sentiment from families and couples shows the impact of the financial bite.

Nearly 4 in 10 (39%) Aussies noted that financial pressures are having considerable or very strong negative impacts on their personal/household wellbeing in 2022 – perhaps highlighting the ultimate rising cost we may have to struggle with.

As might be expected, many parents (68%) are trying to keep any financial stress experienced from the rising cost of living from their children.

Despite the less-than sunny financial forecast, if there is one thing we have fine-tuned through the experiences of the last few years, it’s resilience. The ability to adapt to the rapidly changing ‘new normal’ is a challenge, but one we are all going through together.

The above information has been sourced from The Real Aussie Financial Bite Report, available on the Real Insurance Website.