Life insurance for diabetics

Yes, you can get life insurance if you have diabetes. Find out how it works, what to expect, and how to apply...

Skip the guess work and do it the simple way with our life insurance calculator.

If you have no dependants or mortgage to take care of, you may consider that you have minimal need for life insurance. But consider what your needs will be in the event you suffer a serious illness or a permanent disability. The impacts on you and those close to you could be financially significant.

Life insurance can help you protect the financial priorities in your life. You can rest easier knowing that your loved ones, any debts, and your final expenses could be taken care of with your life insurance.

You may want to consider adding Serious Illness Insurance or Total & Permanent Disability Insurance to your life insurance policy. Paying for medical bills and private care isn’t easy on a single income – even more so if you weren’t able to work at all. In this instance, your life insurance payout could help you keep living independently if you became physically restricted, such as by installing medical equipment in your home to assist with daily tasks. You can even put it towards rehabilitation or in-home assistance to potentially get your life back on track.

Learn more about life insurance for singles.

Your lifestyle might change as you and your children get older, but the need for financial security stays the same. As your children approach their teens or early adult years, it’s common for them to have aspirations you need to provide for. Whether it’s supporting their dream of becoming a sports star or studying at university, the financial commitments can start to pile up for established families.

A growing family may move (or plan to move) into a bigger living space, so it’s important to factor this into your life insurance cover amount. You and your partner may consider whether just one of you needs to be covered or even taking out a policy each to provide extra financial protection in case either one of you were no longer around to provide for your family.

Read more on how life insurance can help established families.

After decades of hard work, life may reward you with time to yourself as you get older. Your later years are the perfect time to unwind, relax and enjoy your time out of the workforce – you’ve earned it! At this stage in your life, you are likely to have significantly paid down your debts and you may have fewer financial dependants. However, it’s still important to assess your needs and confirm that you have sufficient funds to cover you and your family, if the worst were to happen. Life insurance is something you could consider as a means of filling the gaps in any plans.

Talking with your loved ones about their future endeavours is a great way to work out how much cover you might need in case you pass away or suffer a terminal illness.

Find out more about life insurance for seniors.

Skip the guess work and do it the simple way with our life insurance calculator.

It’s easy to fall into the habit of settling with what you have currently, but it’s worth keeping an eye on your life insurance to make sure it’s working as hard as you are. If it’s been a few years since you last looked at your policy, or if your circumstances have changed with work, your income, or more children, then it could be a good time to review your level of cover and inclusions.

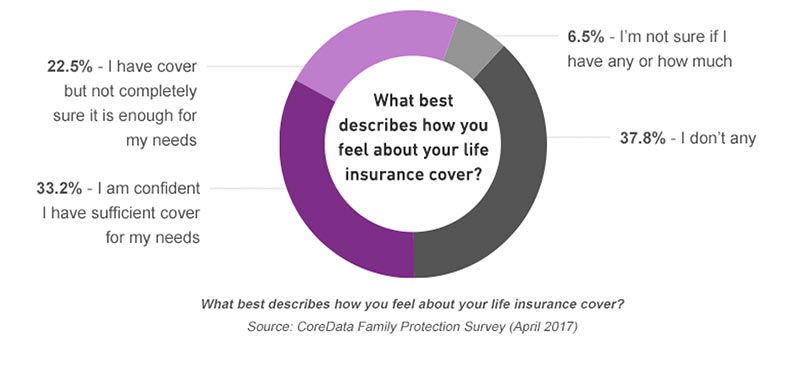

The Real Family Protection survey found that almost 30% of Aussies are unsure if their level of cover would be enough to meet their family’s needs or whether they have cover in place at all. Instead of keeping yourself up at night with more things on your mind, consider reviewing your policy by factoring in how your needs have changed over the years. You might find your level of cover just isn’t cutting it for what you want for your loved ones, when you pass away. After all, if you’re paying for life insurance then there’s no reason you shouldn’t have maximum peace of mind!

You can use the life insurance calculator to help determine how much cover you might need, remembering to take into consideration all factors such as income, any debts and potential risk factors.

Once you’re happy with your estimated cover amount, simply request a life insurance quote. Just answer a few simple questions and one of our Australian-based agents will call you to discuss your insurance needs. As long as you are an Australian resident and aged between 18 and 74, you can apply for a life insurance policy.

Once your policy is accepted, you will have peace of mind knowing you are protecting yourself, your lifestyle and your future.

Rated from 2,071 Feefo reviews

Powered by

1. Mind the gap: How to provide the Australian community with the life insurance it needs – Deloitte