The irrational cost of love

Love is blind. It can make your head spin and take you in a direction you never thought it would. It’s famous for fostering foolish behaviour and making normally rational people act in totally irrational ways. So, does being crazy in love justify the fact that young Australian couples are prepared to spend an average of $65,482 on their wedding day? SIXTY FIVE THOUSAND DOLLARS.

That is 56% of the average Australian couple’s income. It’s also a deposit on a house or nest egg to kick-start your new life together.

According to a recent Money & Marriage Survey* conducted for Real Insurance, it appears that young Aussie couples are thinking short term and ignoring the impact their special day may have on their future. In fact, only 2 in 5 (40%) are planning to pay for their wedding up front which leaves a whopping 60% facing paying off debt in their honeymoon years.

How do couples plan on managing finances once they are married?

Overall 55% of engaged or married couples in Australia say they will combine their finances, 37% will partly combine their finances and only 8% will maintain their own finances. Tasmanians are more likely to seek financial commitment with 86% looking to combine their finances, and those living in the capital are more likely to seek financial independence with 21% holding onto their own purse.

The older couples get the more likely they are to want to keep their finances separate from their partner with 27% of those over 50 wanting to manage their own finances. And the younger you are the more likely you are to combine your finances, with 68% of 18–24 year olds looking to open up joint accounts.

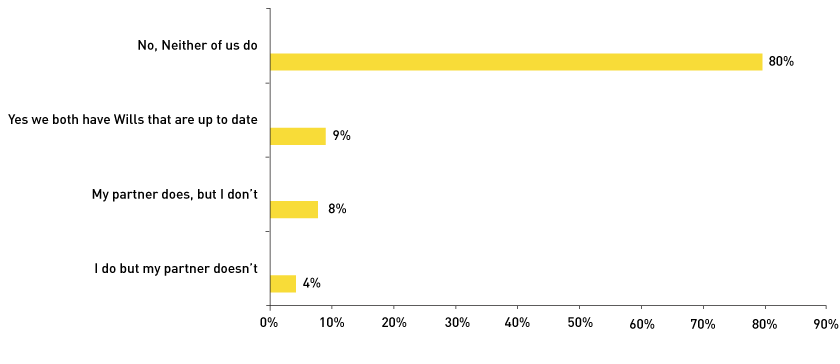

With most couples sharing their finances it is important they have a plan in place to ensure that have access to these financial assets should the unthinkable happen – yet only 9% of couples both have a will that is up to date

Do you or your partner have an up to date will?

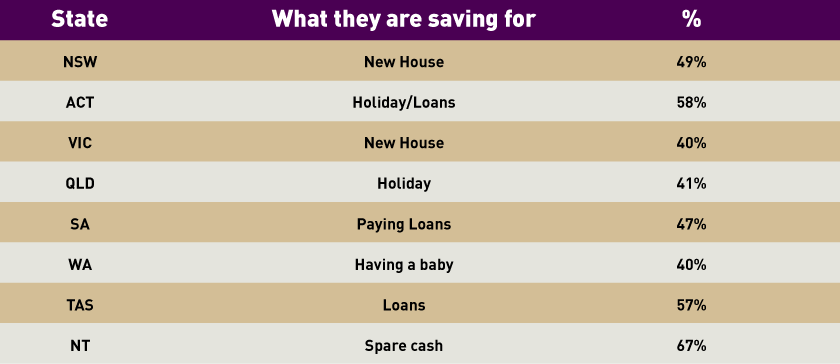

What do couples want to save for in their first year of marriage?

Across the country, the idea of owning a home is still a priority, and the stress of planning a wedding leading to 40% of newlyweds planning a holiday. Image map of Australia with following stats:

Aussie couples are short-sighted when it comes to finances

Despite couples’ best intentions to plan and save for the cost of their wedding, most couples will be faced with a wedding day debt of $34,232 with no immediate financial plan to begin to pay it off.

Rather than their debt commitments they are more likely to be making plans for their future together, and making a financial plan should one of them be unable to work or no longer be around will be the last thing on their mind. In fact less only a quarter of surveyed couples have income protection or life insurance. Those in NSW seem less concerned about this type of financial planning with only 19% holding these types of insurance. Queenslanders are more prepared for an unexpected death with 31% holding life insurance and South Australians are more likely to be ready to be out of work with 36% holding income protection insurance.

27 Mar 2015